In the banking world, things are changing fast, and a big reason behind it is “Data Analytics.” It’s not just a fancy term; it’s become a game-changer. Why? As technology, customer expectations, and market behavior shift, Banking Analytics helps banks do things better.

Now, in the age of digital everything, Banking Analytics is crucial. It’s the key to making customers happy, finding ways to make more money, and staying in the game in this crazy financial world.

In this blog, we will explore how developing Data Analytics skills can meet these evolving demands and serve as a key strategy to future-proof your banking career.

Banking Analytics Solutions

The banking industry evolves with technology, customer expectations, regulations, and global economic changes. Here are some evolving demands and how Banking Analytics addresses them:

Personalized Customer Experience:

- Demand: Customers seek tailored/personalized experiences.

- Role of Data Analytics: Analyze customer data for insights, enabling customized and personalized products, services, and communication.

Fraud Detection and Prevention:

- Demand: Growing need for robust fraud prevention.

- Data Analytics Role: Use advanced models to analyze patterns, anomalies, and real-time transactions for identification and prevention.

Risk Management:

- Demand: Effective management of credit, market, and operational risks.

- Data Analytics Role: Utilize predictive banking analytics and modeling to assess and manage risks based on historical data and market trends.

Regulatory Compliance:

- Demand: Adherence to complex regulatory standards.

- Data Analytics Role: Automate compliance monitoring with banking analytics tools, facilitating real-time adherence to regulatory changes.

Digital Transformation:

- Demand: Adaptation to digital banking and fintech innovations.

- Data Analytics Role: Optimize user interfaces, develop digital products, and evaluate the impact of digital initiatives using banking analytics insights.

Cost Optimization and Efficiency:

- Demand: Pressure to reduce costs and enhance efficiency.

- Data Analytics Role: Identify inefficiencies, streamline processes, and optimize resource allocation through data-driven decision-making.

Cybersecurity:

- Demand: Prioritize cybersecurity against increasing threats.

- Data Analytics Role: Monitor network activity, detect patterns, and provide real-time alerts using analytics tools.

In summary, Data Analytics is pivotal in meeting evolving industry demands, offering actionable insights, improving decision-making, enhancing customer experiences, and ensuring compliance and security.

Is College

Worth It Anymore?

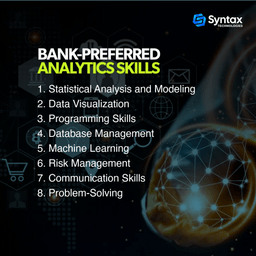

Banking Analytics Skills Highly Valued by Employers

Professionals in banking who have expertise in Data Analytics often possess a combination of technical, analytical, and business skills. Here are some of the Financial Data Analytics skills highly valued by banking employers:

Statistical Analysis and Modeling:

- Importance in Banking: Crucial for predicting financial trends, assessing risk, and making data-driven decisions.

Data Visualization:

- Importance in Banking: Enables clear presentation of complex financial data, aiding in decision-making and strategy formulation.

Programming Skills:

- Importance in Banking: Essential for data manipulation, analysis, and automation of financial processes.

Database Management:

- Importance in Banking: Facilitates efficient handling and querying of large financial datasets, supporting various banking operations.

Machine Learning:

- Importance in Banking: Applied in credit risk assessment, fraud detection, and customer segmentation for more accurate decision-making.

Risk Management:

- Importance in Banking: Analytical skills are vital for modeling and managing credit risk, market risk, and operational risk.

Communication Skills:

- Importance in Banking: Facilitates effective communication of analytical insights to stakeholders, aiding in informed decision-making.

Problem-Solving:

- Importance in Banking: Essential for identifying and addressing financial challenges, optimizing processes, and enhancing overall efficiency.

Making Your Job Better Now and Future-Proofing Your Career

Acquiring Data Analytics in the banking sector can significantly enhance your current role and future-proof your career against industry shifts. After having discussed these skills in the above section, here are some key ways in which possessing them can benefit you:

Informed Decision-Making:

Using data-driven insights to navigate complexities, improving the overall effectiveness and strategic impact of your choices.

- Current Position: Enhances your ability to make strategic decisions based on comprehensive data analysis.

- Future-Proofing: Positions you as a decision-making authority, ensuring your role remains indispensable in a rapidly changing financial landscape.

Risk Management Expertise:

Ability to assess and handle potential threats, safeguarding the financial stability of your organization.

- Current Position: Positions you as a key player in identifying and mitigating financial risks within your organization.

- Future-Proofing: Demonstrates your expertise in dealing with uncertainties, making you an essential asset as the financial sector evolves.

Customer-Centric Approach:

Understanding and addressing the unique needs of clients, fostering loyalty and trust.

- Current Position: Strengthens client relationships and satisfaction through personalized solutions.

- Future-Proofing: Showcases your adaptability to changing customer needs, securing your position as a customer-focused professional.

Fraud Detection Ability:

Utilizing analytical tools to identify irregularities and prevent unauthorized activities, ensuring the security of financial transactions.

- Current Position: Safeguards financial transactions, ensuring the integrity of your organization.

- Future-Proofing: Highlights your commitment to cybersecurity, making you essential in an increasingly digitized banking environment.

Operational Efficiency Champion:

Optimizing processes to improve productivity, reduce costs, and enhance overall organizational effectiveness.

- Current Position: Data analytics in banking contributes to streamlined processes and cost-effectiveness in your current role.

- Future-Proofing: Positions you as an efficiency expert, crucial for staying competitive in a rapidly changing industry.

Future Trends Forecaster:

Using data to forecast trends and potential future scenarios, guiding proactive decision-making for sustainable success.

- Current Position: Data analytics in banking allows for proactive decision-making based on market trends.

- Future-Proofing: Demonstrates your ability to anticipate changes, making you an asset in navigating future financial landscapes.

Continuous Learning Advocate:

Actively seeking and embracing opportunities for ongoing professional development to stay ahead in a rapidly evolving industry.

- Current Position: Data analytics in banking reflects your commitment to staying updated with industry trends.

- Future-Proofing: Demonstrates your proactive approach to learning, securing your relevance in an industry that values innovation.

Career Transition Toolkit

Conclusion

In a rapidly evolving banking landscape, embracing Data Analytics is not just a skill; it’s a strategic need. The ability to utilize the power of data is a game-changer, providing a competitive edge and future-proofing your career.

As you get on this journey to acquire Data Analytics skills, consider the Data Analytics and Business Intelligence course offered by Syntax Technologies. This comprehensive program covers essential skills needed in different industries and can be a wise choice for anyone looking to secure a foolproof tech career.